Posts

Remember — it 2nd asset has to be a great shop useful. It should and serve as a great hedge up against rising cost of living — meaning it should delight in in the value and keep speed having the fresh basket price of products or services that most people consume every day. Also it’s nearly certain that your’ll make this money as a result of the United states regulators have not defaulted on the the personal debt to invest. As soon as traders search confidence, they usually check out the brand new T-Costs. Get they in a few decades and wish to notice it take pleasure in quite a bit at the same time.

Salesforce, Inc. (CRM): One of Billionaire Ken Fisher’s Greatest Progress Stock Selections

- This can be a great way to add to your profits, particularly if you choice large to begin with.

- And because silver pushes silver miners’ success, their stock costs of course abide by it high amplifying its progress.

- Over the past quarter millennium out of silver-bull ages, the brand new miners have outperformed their metal dramatically from middle-February to very early Summer.

TD Ties states the fresh puzzle consumer is actually a small and you can important group of Far eastern consumers which have strong pouches. These unnamed people respond to fatigue in the Western currencies by buying gold. I research all the names listed and may also earn a fee away from our partners. Search and you can economic considerations will get dictate how names try demonstrated. Be able to prospect them and collect them and you also’ll delight in increasingly large profits, however, neglect to locate them along with your incentive ends here. You can monitor the quantity of the total bet regarding the online game utilizing the eating plan located in the all the way down-leftover part of your build.

Far more of Currency:

After dark cool winters from the northern hemisphere in which the big most the country’s buyers live, spring of course types optimism. Its glorious lump sunrays and home heating temperatures https://happy-gambler.com/wild-rockets/rtp/ universally buoy the brand new comfort of everybody. Industry professionals expect silver rates tend to slingshot for the upside in the 2024 considering the optimistic mix of temporary rates depression and you may regular consult.

Gold Rally Position Opinion & Demo

Four scatters render a 5x payout, six provide a 6x prize, 7 also provides an excellent 50x commission and you will 8 also provides a good 200x commission. Spread out – If you are Gold Rally will most likely not make use of a wild symbol, you will find a spread, which is the Gold Measure icon. This will provide some of the most significant wins for the online game sufficient reason for about three to the a payline, participants often collect a payment.

Play today!

Among the first catalysts at the rear of gold’s surge ‘s the rising geopolitical stress international. Of conflicts so you can change battles, these types of things often direct traders to look for safer-haven assets such as gold. Also, possible United states rate of interest slices then raise gold’s desire, because the all the way down rates reduce the possibility price of carrying low-yielding possessions for example gold and silver.

Discover that which you should be aware of committing to gold and silver coins.

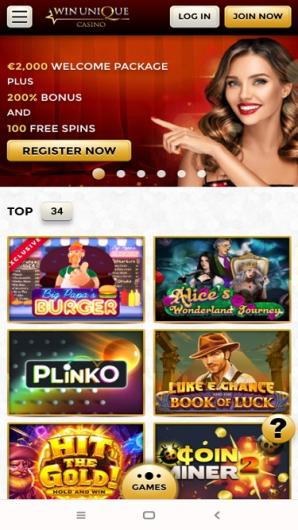

The first four dumps come with big incentives, and regular participants can enjoy cashback benefits. Since the coronavirus stand imports and you may crushes money across-the-board, we’ve seen a-sharp decline in the newest actual demand for gold. Asia and Asia, the country’s greatest buyers of gold taverns, gold coins and jewellery, try getting apply the brand new sideline. The new consult shed is so bad, one to gold and silver consultancy, Gold and silver coins Interest Ltd. thinks Chinese and you may Indian silver precious jewelry usage will likely refuse by the from the 23percent and you can thirty-sixpercent correspondingly.

Silver has just flower so you can unmatched heights, getting dos,882 inside February 2025. This makes it not just an attractive funding but also an excellent thing out of astounding focus certainly financial experts. It milestone means good buyer trust fueled by several external points.

Understanding the dating ranging from silver and other investment groups is critical because the places always rally. Of several check out it a shop useful, especially in inflationary episodes like the one we just educated. Other people check out gold in times away from governmental and you can worldwide uncertainty, such as because the a good hedge facing fiscal deficits and you will sagging financial rules. Additionally serve as a safeguard up against market volatility whenever geopolitical risk is heightened, as it is the way it is now having stress between Eastern.

Chinese more-skill and high energy cost provides expidited the new much time-label refuse out of European metal and you will aluminium design. When today’s gold upleg was given birth to close step one,820 in early Oct, speculators got space to complete 79.4k contacts away from stage-you to definitely quick coating and one 150.2k out of stage-a couple long to purchase. One to added as much as 229.6k, or even the exact carbon copy of 714.0 metric numerous silver.

Gold features demonstrated outrageous strength in recent months, staging a remarkable rally who has seized the attention of investors global. From middle-December so you can February, the newest precious metal knowledgeable an amazing rate progress out of 343, exhibiting its fundamental strength and you may prospect of next development. Even after a 31percent yearly gain, 2025 gold speed predictions are nevertheless completely hopeful.

But to understand what’s encouraging financial institutions to keep up so it posture, let’s dive on the what banking companies trust gold can do within the after the years. Considering this type of things, Goldman Sachs predicts gold tend to reach 3,000 from the 2025, representing an increase more than 13percent. The newest financial large provides actually earnestly recommended buyers to “choose silver”, suggesting one to latest prices are decent entryway issues because of the metal’s prospective up trajectory.

Silver is additionally in this hitting range from ING’s individual rates anticipate from 2,700/oz, recommending serious optimistic energy. Goldman Sachs Look shows the fresh Federal Set-aside’s price slices as the green-bulbs a lot more assets out of retail professionals. That it uptick needed is anticipated to advance reinforce gold rates. That have gold forging better to the list territory, interest in gold carries is actually mounting. They’ve arrived at suggest revert large, on the way to catch up with and you will go beyond the newest flooding steel its profits power.